GPU Cloud Instance

Our cloud service makes it easy to deploy container-based GPU instances in seconds, from either public or private repositories. This means that you can get started with GPU computing quickly and easily, without having to worry about managing your own hardware.

Cloud Mining

À tout moment et en tout lieu ! Nous nous occupons des processus fastidieux afin que vous puissiez vous détendre en profitant de récompenses. Commencez à miner en quelques clics !

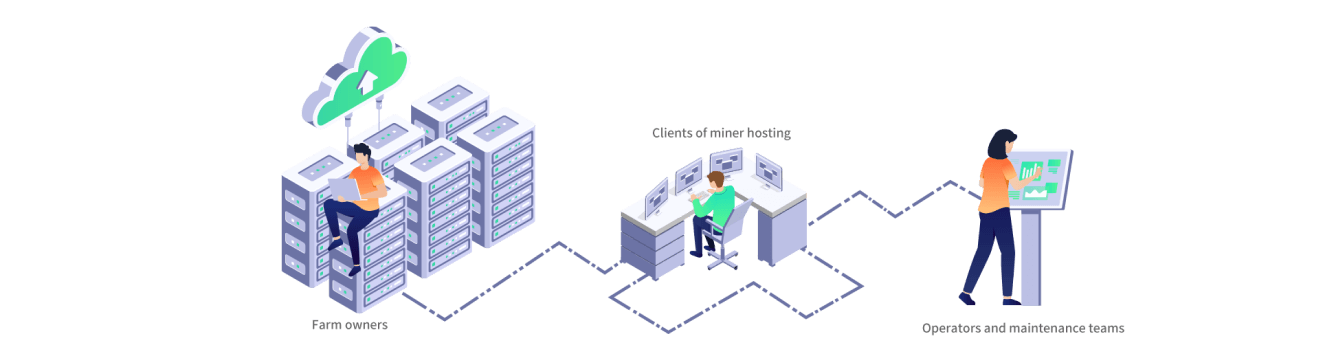

Minerplus

La gestion de votre centre de données vous pose problème ? Nous sommes prêts à vous aider à déployer des systèmes de gestion à interface unique.

Ressources

Parcourez notre centre de ressources pour trouver ce dont vous avez besoin. Abonnez-vous pour rester informé de nos dernières actualités, annonces et publications.

Abonnez-vous à notre bulletin d’informations

Blog sur les crypto et le minage de Bitcoin . Oct 16 2023

Crypto Whales: How It Works And What You Need To Know

"Crypto whales" stand out as both mysterious and influential in the world of crypto. In this article, we will delve into the realm of crypto whales and learn about their impact on the crypto market and how their actions can sway prices and trends. Learn more here.

"Crypto whales" stand out as both mysterious and influential in the world of crypto. In this article, we will delve into the realm of crypto whales and learn about their impact on the crypto market and how their actions can sway prices and trends. Learn more here.

What Are Crypto Whales?

Crypto whales are individuals or businesses that frequently can affect pricing direction. They are big market players due to their holdings, which can vary from thousands to millions of coins. Typically, traders, investors, and enthusiasts pay great attention to them. Why should you invest in cryptocurrency?

Why Are Crypto Whales Important?

Crypto Whales have the capacity to influence the market by engaging in massive transactions that can result in major price changes. Whale's trading decisions enhance the market liquidity, which is vital for the efficient running of cryptocurrency exchanges. Whales have a history of using price-fixing strategies to raise the value of cryptocurrencies to their advantage. We can dive into whale movements can be examined for clues concerning market patterns and used as indications of sentiment.

Short-Term Price Spikes

Crypto whales generally own enormous amounts of digital assets. They may opt to carry out massive market orders, which could culminate in significant price impact. For instance, if a crypto whale decides to buy a massive amount of a specific cryptocurrency, it can drive the price upward as traders react to the increased demand.

Pump-and-dump schemes mean crypto whales artificially inflating crypto prices to attract naive investors. The crypto whale then sells its holdings at the inflated price when the price has been driven up to a certain value, making substantial revenue. An example of this is the infamous case of "Bitconnect." In 2017, Bitconnect's price was artificially pumped through marketing tactics and endorsements. The scheme's bitcoin whales dumped their holdings at the peak, sending the crypto into a free fall and leaving many investors with significant losses. Learn more here on how to avoid crypto scams.

Stop-loss orders are placed by traders to limit their potential losses when a cryptocurrency's price goes against their position. Crypto whales may execute a sizable sell order, causing the price to plummet and setting off a chain reaction of stop-loss orders, if they wish to buy more of a certain cryptocurrency at a lower price. Once these orders are filled, the whale can profit from the price manipulation by purchasing the cryptocurrency back at a cheaper cost. That's called " Stop Hunting".

Long-Term Price Impact

Crypto whales regularly play in long-term strategy games. They build up sizable positions in a cryptocurrency while its price is low, profiting from the bear market or negative periods. When they have accumulated a sizeable sum, they can decide to sell off their crypto assets at a time when the price is high.

We can take the example of Ethereum (ETH) and the actions of early adopters. Some of the earliest investors who bought ETH at a fraction of a cent during its initial coin offering (ICO) have become crypto whales over time. They were able to sell their ETH holdings at a sizable profit when Ethereum's price rose in the years that followed, which resulted in large price swings over time.

Their actions can either inspire trust or cause doubt within the community. Positive endorsements, strategic partnerships, or large-scale investments by crypto whales can boost confidence, attracting more investors and driving long-term adoption.

Many investors were in support of the collaboration between large financial institutions and Ripple Labs, the firm that created XRP. It was interpreted as a hint of XRP's long-term potential. The U.S. Securities and Exchange Commission (SEC), however, sued Ripple Labs in late 2020, asserting that XRP was an unregistered security.

As a result of this action, confidence declined and some significant exchanges delisted XRP. Whales that held XRP certainly had to make important choices, such as whether to keep investing in the cryptocurrency or sell their holdings, which could have had an impact on its long-term worth.

How Do You Identify Crypto Whales?

Although discovering them might not be intuitive, the tools and techniques at hand can assist in illuminating these crucial industry participants.

By following wallet addresses with sizable holdings and observing their transactions, you can spot prospective crypto whales. We can investigate whale-watching apps like Whale Alert, which will offer us information about the biggest cryptocurrency holders and their most recent transactions from a variety of websites and tools.

In addition, some exchanges offer insights into large trades, allowing traders to spot whales in action. For social media enthusiasts, there is also the option of following crypto influencers on platforms like X (formerly Twitter), where they often share and discuss their strategies and crypto holdings.

Should Investors Follow Crypto Whales?

Investors can learn about market sentiment and trends by keeping an eye on the activity of the crypto whales. With the useful knowledge, making wise trading judgments may become straightforward.

Unfortunately, some gullible investors follow them blindly and may fall for their ruses. However, because crypto whales usually work with huge sums of money, it might be difficult for smaller investors to successfully copy their strategies. Learn more about how to invest in cryptocurrency.

Before attempting to follow whales, it is advised for beginning investors to become familiar with the principles of cryptocurrency trading and to do extensive study.

Who Are the Biggest Crypto Whales?

Due to the anonymity of cryptocurrency transactions, it can be difficult to pinpoint the precise identities of the biggest crypto whales, but there are several well-known people in the industry who are acknowledged as important participants.

- Satoshi Nakamoto: The pseudonymous inventor of Bitcoin, who is thought to own a sizable amount of the currency. However, there is no way for us to know if he is still alive.

- Vitalik Buterin: He is regarded as a significant Ethereum whale because he founded the platform and had 355,000 ETH and other sizable crypto holdings, according to earlier reports.

- Michael Saylor: A businessman from the United States and one of the biggest Bitcoin whales, possesses more than 17,732 bitcoins, totaling more than $1.14 billion. His business, MicroStrategy, has a sizable Bitcoin reserve as well.

- Barry Silbert: The founder of Digital Currency Group, an investment firm with holdings in numerous cryptocurrency-related companies.

Are Crypto Whales Good or Bad?

Crypto whales may have both positive and negative effects. Whales may offer liquidity, which supports the stability of the market. Early adopters like many whales help the growth and development of cryptocurrencies.

While some crypto whales engage in unethical behavior that could endanger other investors. Concerns about wealth distribution in the bitcoin field may arise due to the whales' influence over substantial crypto holdings.

Do I Need to Whale Watch?

It's up to your target. For traders and people who have a thorough understanding of market dynamics, it's frequently more pertinent whale watching. Focusing on fundamental analysis, project research, and risk management may be more advantageous for casual or long-term investors.

Start Your Crypto Investing Journey with Bitdeer Today!

If you're interested in cloud mining and want to start your crypto investing journey, Bitdeer offers a user-friendly platform for mining top cryptocurrencies. Join Bitdeer today and explore the world of cryptocurrency with ease! To learn more about crypto, check out our guides on alternatives to mining bitcoin or from our learning hub.

DISCLAIMER

*Information provided in this article is for general information and reference only and does not constitute nor is intended to be construed as any advertisement, professional advice, offer, solicitation, or recommendation to deal in any product. No guarantee, representation, warranty or undertaking, express or implied, is made as to the fairness, accuracy, timeliness, completeness or correctness of any information, or the future returns, performance or outcome of any product. Bitdeer expressly excludes any and all liability (to the extent permitted by applicable law) in respect of the information provided in this article, and in no event shall Bitdeer be liable to any person for any losses incurred or damages suffered as a result of any reliance on any information in this article.