GPU Cloud Instance

Our cloud service makes it easy to deploy container-based GPU instances in seconds, from either public or private repositories. This means that you can get started with GPU computing quickly and easily, without having to worry about managing your own hardware.

Cloud Mining

À tout moment et en tout lieu ! Nous nous occupons des processus fastidieux afin que vous puissiez vous détendre en profitant de récompenses. Commencez à miner en quelques clics !

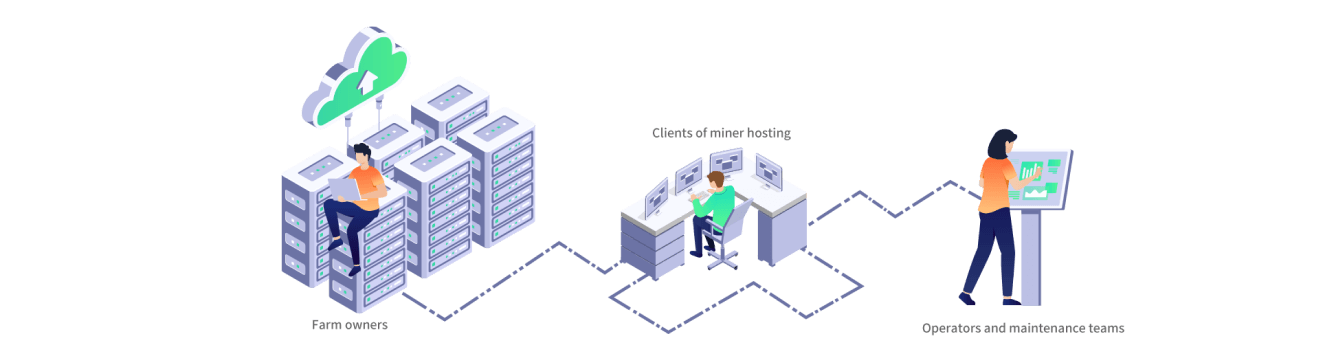

Minerplus

La gestion de votre centre de données vous pose problème ? Nous sommes prêts à vous aider à déployer des systèmes de gestion à interface unique.

Ressources

Parcourez notre centre de ressources pour trouver ce dont vous avez besoin. Abonnez-vous pour rester informé de nos dernières actualités, annonces et publications.

Abonnez-vous à notre bulletin d’informations

Blog sur les crypto et le minage de Bitcoin . Oct 20 2023

Risk Reward Ratio In Cryptocurrency And How To Use It

Discover the significance of the risk-reward ratio in cryptocurrency trading, and how to utilize it to assess potential investments and make informed decisions.

Discover the significance of the risk-reward ratio in cryptocurrency trading, and how to utilize it to assess potential investments and make informed decisions.

What Is the Risk/Reward Ratio?

The Risk/Reward Ratio, often known as RRR or R/R ratio, is a key idea in the financial markets, including the realm of crypto. Its fundamental purpose is to measure prospective profit and potential risk in a trade. The ratio is typically expressed as a fraction or a percentage, indicating the potential reward relative to the risk involved in a particular trade. In simpler terms, it helps traders evaluate whether the potential gains in a trade are worth the risk they are taking.

How to Calculate Risk/Reward Ratio

First and foremost, we must determine the Potential Profit. This illustrates how much money you could earn if the deal is successful. The risk is the loss level you could sustain if the trade does not go as expected.

As a result, to calculate the risk/reward ratio, apply the simple formula below:

Risk Reward Ratio = (The percentage return) / (Maximum drawdown)

- The The percentage return=(Return-Cost)/Cost

- Maximum drawdown=(Cost-Loss)/Cost

What factors should be considered while determining the risk/reward ratio in cryptocurrency trading?

The risk that traders will take to achieve their intended profits is frequently influenced by a number of factors. To name a few:

Volatility of the Crypto Market

Crypto prices can experience rapid and substantial fluctuations in a short period that reflect the market trend and sentiment. The level of volatility in the crypto market often correlates with the recognition of a token; lesser-known tokens tend to exhibit higher volatility, while well-established coins typically demonstrate comparatively lower price fluctuations. Traders should be cautious and adapt their risk management strategies accordingly.

Liquidity

Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. In cryptocurrency trading, the liquidity of a particular coin or token can greatly impact the risk/reward ratio. More liquid assets generally have tighter spreads and lower slippage, making it easier to enter and exit positions. Illiquid assets may have wider spreads and higher slippage, increasing the risk.

Strength of Underlying Technology

Every cryptocurrency has a different foundational technology, like blockchain, on which it is constructed. When evaluating the risk/reward ratio, traders should take the power and dependability of this technology into account. When compared to less stable initiatives, a cryptocurrency with strong, secure, and cutting-edge technology is more likely to draw long-term investment, thereby lowering the risk.

Regulatory Landscape

From one region to another, the regulatory environment for cryptocurrencies differs greatly. Regulation changes may affect a cryptocurrency's risk profile. Traders should keep up with regulatory changes in the nations where their preferred assets are traded. Trade risks can increase due to regulatory uncertainty.

To handle the inherent hurdles and uncertainties of the cryptocurrency market, it's necessary to keep in mind that while the possibility for profit in cryptocurrency trading is appealing, a strong risk management approach is required. Learn more about:

How crypto is taxed.

Inflationary and deflationary currencies

Pros and Cons of the Risk-Reward Ratio

By allowing traders to establish precise criteria for entry pricing and quitting contracts, the Risk/Reward Ratio offers an organized approach to decision-making. It assists in risk management by minimizing and limiting prospective losses. Traders have the ability to choose their own acceptable loss levels. Traders seek to increase their profits by taking advantage of advantageous situations by aiming for higher reward-to-risk ratios.

Unexpected market events are not taken into consideration by the ratio, making it difficult to anticipate black swan events or abrupt price changes. If you only consider the ratio, you can overlook fundamental research, market mood, or breaking news. Setting rigid risk/reward ratios can put traders under strain psychologically. A high ratio also increases the possibility of bigger losses, may take longer to make the targeted returns, and necessitates accurate trade analysis and prediction. Before choosing to employ a high-risk reward ratio in their forex trading strategy, traders should thoroughly assess their risk tolerance, trading abilities, and market conditions.

How to use Risk-Reward Ratio for Crypto Investment?

To use the Risk/Reward Ratio effectively for crypto investment:

- Define Your Goals: Determine your investment goals, risk tolerance, and preferred risk/reward ratio.

- Research and Analysis: Thoroughly research and analyze cryptocurrencies, considering factors like technology, team, market conditions, and news.

- Set Entry and Exit Points: Identify precise entry and exit points based on your calculated risk/reward ratio. Stick to your plan.

- Diversify Your Portfolio: Spread your investments across multiple cryptocurrencies to reduce risk.

- Stay Informed: Continuously monitor the market and adjust your risk/reward ratios as needed based on changing conditions.

What Is the Optimal Risk/Reward Ratio?

The optimal risk/reward ratio can vary based on individual risk tolerance and trading strategy. However, a commonly recommended ratio is 2:1.

Consider this straightforward example: With an initial capital of $1,000, an investment would yield a $200 return in the event of a successful outcome, while a loss of $100 would result from an unsuccessful investment. This scenario results in a Risk/Reward Ratio (RRR) of 2:1, signifying an investment strategy that seeks to secure a potential gain at least twice the size of the prospective loss, aligning with prudent and objective investment principles.

Can You Rely Only on R/R Ratio to Trade?

While the Risk/Reward Ratio is a valuable tool, it's not advisable to rely solely on it for trading. Cryptocurrency markets are highly dynamic and influenced by a wide range of factors, including news events, market sentiment, and technological developments. No single metric can account for all these variables.

Typically, it is employed in conjunction with complementary risk management metrics, including the win/loss ratio and breakeven analysis. Successful trading requires a holistic approach that combines risk management, fundamental and technical analysis, and adaptability to changing market conditions.

Invest in crypto with cloud mining today!

While risk-reward ratio investing has its merits, cloud mining can offer a more stable and hands-off approach for those seeking a different way to participate in the cryptocurrency market. However, as with any investment, novices should conduct an investigation and grasp the intricacies of cloud mining, and the associated hazards that come with them. Get started with Bitdeer today!

DISCLAIMER

*Information provided in this article is for general information and reference only and does not constitute nor is intended to be construed as any advertisement, professional advice, offer, solicitation, or recommendation to deal in any product. No guarantee, representation, warranty or undertaking, express or implied, is made as to the fairness, accuracy, timeliness, completeness or correctness of any information, or the future returns, performance or outcome of any product. Bitdeer expressly excludes any and all liability (to the extent permitted by applicable law) in respect of the information provided in this article, and in no event shall Bitdeer be liable to any person for any losses incurred or damages suffered as a result of any reliance on any information in this article.