GPU Cloud Instance

Our cloud service makes it easy to deploy container-based GPU instances in seconds, from either public or private repositories. This means that you can get started with GPU computing quickly and easily, without having to worry about managing your own hardware.

Cloud Mining

À tout moment et en tout lieu ! Nous nous occupons des processus fastidieux afin que vous puissiez vous détendre en profitant de récompenses. Commencez à miner en quelques clics !

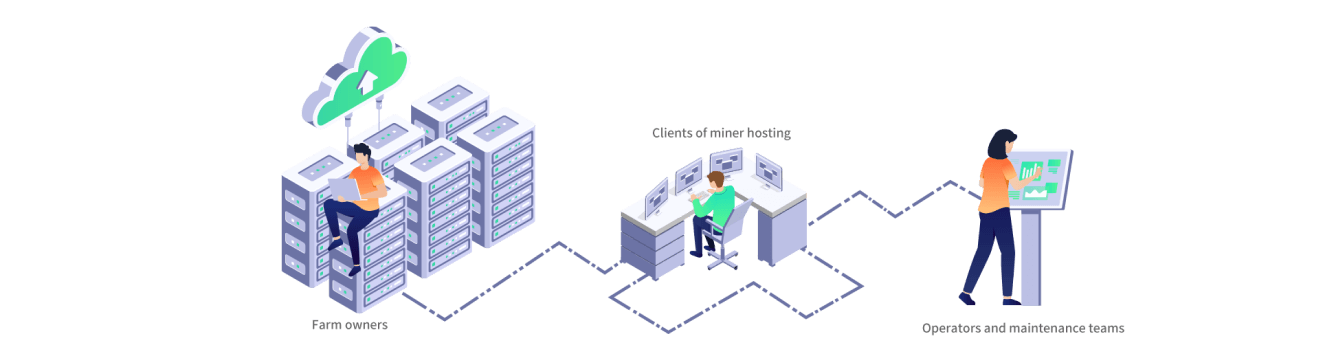

Minerplus

La gestion de votre centre de données vous pose problème ? Nous sommes prêts à vous aider à déployer des systèmes de gestion à interface unique.

Ressources

Parcourez notre centre de ressources pour trouver ce dont vous avez besoin. Abonnez-vous pour rester informé de nos dernières actualités, annonces et publications.

Abonnez-vous à notre bulletin d’informations

Blog sur les crypto et le minage de Bitcoin . Aug 21 2023

Crypto Token Supply Defined: What The 3 Main Supplies Mean

Unravel the meaning of circulating supply, total supply, and maximum supply in crypto. Gain a clear understanding of how they impact the crypto market. Learn more.

Unravel the meaning of circulating supply, total supply, and maximum supply in crypto. Gain a clear understanding of how they impact the crypto market. Learn more.

How Many Coins Are in Circulation?

In August 2023, the crypto landscape boasted around 23,000 cryptocurrencies. However, not all of these digital assets are active or valuable. If we focus solely on the active ones, we're left with approximately 9,249 cryptocurrencies.

The combined market capitalization of all cryptocurrencies currently stands at a staggering $1.04 trillion, despite experiencing a recent 30% decrease. (Data Resource: CoinMarketCap.com & Blockchair)

On a global scale, the crypto sphere boasts more than 300 million users, with roughly 18,000 businesses now embracing cryptocurrencies as payment. Interestingly, Asia stands out as the frontrunner with more than four times the number of crypto users compared to any other continent.

Furthermore, a remarkable 95% of individuals involved in cryptocurrencies, or those simply curious about them, are well aware of Bitcoin.

What is a Crypto Token Supply?

Within the realm of cryptocurrencies, the term 'token supply' pertains to the total number of coins or tokens existing within a specific blockchain ecosystem. This factor holds immense importance, directly influencing a cryptocurrency's value and rarity.

Circulating Supply

What is circulation supply?

Circulating supply represents the total number of coins or tokens actively circulating in the open market, available for trading. This figure excludes tokens held by project teams or locked away in smart contracts. Circulating supply is a crucial metric for assessing a cryptocurrency's market capitalization and potential for future price fluctuations.

To illustrate, if a cryptocurrency has a total supply of 21 million coins and 19.4 million coins are actively trading, the circulating supply would be 19.4 million coins.

How Does Circulating Supply Affect Cryptocurrency Price?

The circulating supply of a cryptocurrency exerts a substantial influence on its price dynamics. Generally, a lower circulating supply indicates greater scarcity, sparking increased demand and, consequently, driving up prices. Conversely, a larger circulating supply suggests more abundant availability, potentially limiting price growth.

To combat the inflation rate and stimulate price appreciation, some projects choose to buy back and destroy a portion of their crypto coins at regular intervals. This strategy capitalizes on the fundamental principles of supply and demand. When digital assets are scarce compared to demand, asset values surge due to increased scarcity. Conversely, an oversupply of assets with insufficient demand tends to depress prices.

Ethereum Improvement Proposal 1559 (EIP-1559), implemented in 2021, brought forth an innovative concept known as 'burn' through Ethereum burn addresses. To date, this mechanism has led to the removal of approximately 3.15 million ETH, which translates to a staggering value of over $5.9 billion.

In essence, token destruction reduces the overall supply of tokens in the market, generating an imbalance in demand that makes the remaining tokens scarcer and more valuable.

Total Supply

What is the total supply?

The term "total supply" describes the total number of coins or tokens that will ever be produced for a specific cryptocurrency. It contains all coins in circulation as well as those that have yet to be released. With restricted total supply, there is a predetermined maximum amount of coins that will ever exist for some cryptocurrencies. Bitcoin, for example, has a total quantity of 21 million coins.

Circulating Supply vs. Total Supply - What's the Difference?

The primary distinction between circulating supply and total supply is the inclusion of coins that have yet to enter circulation. Circulating supply refers to coins that are actively available on the market, whereas total supply includes all coins, including those owned by the project team, in reserve, or not yet minted.

Consider a cryptocurrency with a total quantity of 1,000,000 coins, of which 500,000 are currently in circulation. In this scenario, the circulating supply is 500,000 coins, whereas the total supply is 1,000,000 coins.

Maximum Supply

What is the maximum supply?

Maximum supply refers to the absolute maximum number of coins or tokens that can ever exist for a particular cryptocurrency. It is a hard cap that prevents further issuance beyond the set limit. Some cryptocurrencies have a maximum supply to create scarcity and maintain the asset's value. For instance, Ripple (XRP) has a maximum supply of 100 billion tokens.

What Happens When a Crypto Reaches Max Supply?

When a cryptocurrency reaches its maximum supply, no new coins can be mined or minted. This can have several implications, including increased scarcity and potential price appreciation. With a limited supply, the demand for the cryptocurrency may exceed the available tokens, leading to increased value for existing holders.

Cryptocurrencies are relatively new, so there aren't famous examples of coins hitting their maximum supply yet. But we can analyze this through Bitcoin halving. Bitcoin undergoes a halving event every 4 years where mining rewards are cut in half. Since mining is how new bitcoins are created, halving reduces the supply of new bitcoins. Historically, these events have led to significant price increases as reduced supply increases scarcity, attracting more investors and driving up the price.

Start Your Mining Journey with Bitdeer Today!

Simply said, circulating supply influences a cryptocurrency's price and market capitalization, whereas total supply provides insight into the asset's potential future growth. Maximum supply ensures scarcity and can have an impact on long-term value.

If you are interested in cryptocurrency, Bitdeer offers a convenient and efficient way to start your crypto journey. Notably, conduct thorough research and exercise caution before making any investment in the volatile cryptocurrency market.

DISCLAIMER

*Information provided in this article is for general information and reference only and does not constitute nor is intended to be construed as any advertisement, professional advice, offer, solicitation, or recommendation to deal in any product. No guarantee, representation, warranty or undertaking, express or implied, is made as to the fairness, accuracy, timeliness, completeness or correctness of any information, or the future returns, performance or outcome of any product. Bitdeer expressly excludes any and all liability (to the extent permitted by applicable law) in respect of the information provided in this article, and in no event shall Bitdeer be liable to any person for any losses incurred or damages suffered as a result of any reliance on any information in this article.