GPU Cloud Instance

Our cloud service makes it easy to deploy container-based GPU instances in seconds, from either public or private repositories. This means that you can get started with GPU computing quickly and easily, without having to worry about managing your own hardware.

Cloud Mining

À tout moment et en tout lieu ! Nous nous occupons des processus fastidieux afin que vous puissiez vous détendre en profitant de récompenses. Commencez à miner en quelques clics !

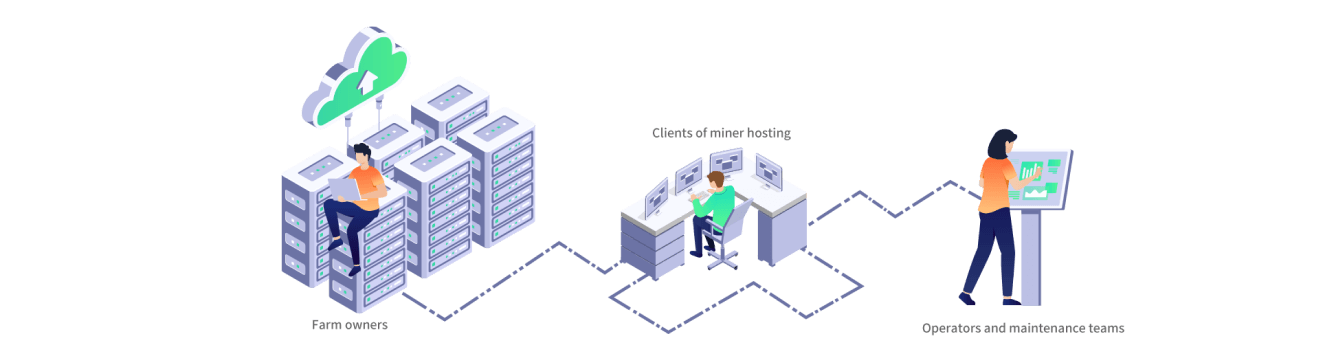

Minerplus

La gestion de votre centre de données vous pose problème ? Nous sommes prêts à vous aider à déployer des systèmes de gestion à interface unique.

Ressources

Parcourez notre centre de ressources pour trouver ce dont vous avez besoin. Abonnez-vous pour rester informé de nos dernières actualités, annonces et publications.

Abonnez-vous à notre bulletin d’informations

Blog sur les crypto et le minage de Bitcoin . Sep 18 2023

Deflationary & Inflationary Cryptocurrency - What It Means

Among the myriad of cryptocurrencies, some operate on inflationary regulations, while others follow deflationary models. This article explores the implications of deflationary and inflationary cryptocurrencies. Understand their effects on the value and how they affect cryptocurrency prices.

Among the myriad of cryptocurrencies, some operate on inflationary regulations, while others follow deflationary models. This article explores the implications of deflationary and inflationary cryptocurrencies. Understand their effects on the value and how they affect cryptocurrency prices.

Inflationary Cryptocurrencies

What is an inflationary cryptocurrency?

Inflationary cryptocurrencies are crypto assets designed to increase their supply in circulation over time. New coins or tokens are continually minted or mined, contributing to a growing supply. The goal is to prevent scarcity and promote spending and circulation, mimicking the behavior of traditional fiat currencies.

How Does an Inflationary Cryptocurrency Work?

Inflationary cryptocurrencies frequently use freshly produced tokens to fund network growth, marketing, and community participation. This concept tries to balance scarcity and usability, making these cryptocurrencies suitable for various instances like digital payments, transfers, and tips.

We can take the Dogecoin as an example. It was initially launched with an initial supply of 100 billion coins, and in 2014, the previously imposed limit on the total supply was removed, thereby establishing an unlimited supply of assets. Owing to its unvarying block rewards, Dogecoin sustains a comparatively elevated inflation rate when juxtaposed with Bitcoin. This continuous inflationary mechanism theoretically facilitates the expansion of the Dogecoin supply, rendering it more widely accessible.

The inflationary nature of Dogecoin was initially intended as a lighthearted joke and to promote a sense of community by making the currency more accessible to a broader audience. However, it also means that Dogecoin doesn't have the same store-of-value properties as Bitcoin.

Best Inflationary Cryptocurrencies

- Dogecoin (DOGE)

As previously noted, famous for its meme status, Dogecoin regularly issues new tokens, maintaining a lively and engaged community.

- Ripple (XRP)

The XRP of Ripple has a minor inflationary mechanism. XRP is pre-mined, and a small amount of XRP is destroyed with each transaction to avoid spam. However, the overall amount of XRP is rather vast, and no additional XRP can be mined.

- Stellar (XLM)

The Stellar follows an inflationary model as well. Although 100 billion XLM tokens were first issued, Stellar.org distributes a fraction of these tokens on an annual basis to assist network development and user growth.

Deflationary Cryptocurrencies

What is a deflationary cryptocurrency?

Deflationary cryptocurrencies operate in a way that reduces supply in circulation. They aim to create scarcity, encouraging users to hold and invest in the cryptocurrency with the expectation of increased value, much like traditional deflationary assets such as gold.

How Does a Deflationary Cryptocurrency Work?

As previously stated, the quantity of Bitcoin is limited to 21 million coins. As more Bitcoins are mined, mining rewards diminish over time, making it increasingly difficult to mine new coins. This declining supply process is at the heart of Bitcoin's deflationary nature. Deflationary cryptocurrencies frequently attract investors looking for long-term value appreciation and function as a store of value in a similar way as gold.

Best Deflationary Cryptocurrencies

- Bitcoin (BTC)

As the first cryptocurrency, Bitcoin remains the most prominent deflationary crypto asset, with a finite supply of 21 million coins. The halving event occurs roughly every 4 years and reduces the mining rewards BTC miners earn for their efforts, directly affecting BTC scarcity.

- Ethereum (ETH):

Ethereum 2.0 introduces a deflationary mechanism utilizing "burning addresses" to emphasize the scarcity of Ether's value, transforming it into a deflationary cryptocurrency.

- Stablecoin(USDT/USDC)

Stablecoins like TerraUSD employ a minting and burning mechanism. This process involves creating and eliminating tokens as needed, ensuring that the stablecoin's price remains consistently pegged to the US dollar.

What is the difference between inflationary and deflationary cryptocurrencies?

Fixed vs. Floating

The fundamental difference between inflationary and deflationary cryptocurrencies lies in how they manage their supply. Inflationary cryptocurrencies have a floating supply that can increase over time, while deflationary ones have a fixed supply that decreases or remains constant.

Demand and Supply

Inflationary cryptocurrencies often employ a mechanism where new tokens are mined to meet the growing demand. This approach ensures a steady supply that can adapt to market needs. Conversely, deflationary cryptocurrencies cap their supply, resulting in scarcity as demand rises, potentially driving up their value.

Purchasing Power

Inflationary cryptocurrencies tend to have decreasing purchasing power due to their continuously expanding supplies, while deflationary cryptocurrencies often have increasing purchasing power due to their limited supply. These dynamics can influence how these cryptocurrencies are used as stores of value or mediums of exchange in different economic systems.

Conversion

The rising quantity of inflationary tokens raises the possibility that they will lose value when traded for other assets. In contrast, deflationary tokens frequently appreciate, making them appealing for long-term investment and storage of wealth.

How to Determine Whether a Cryptocurrency Is Inflationary or Deflationary

Maximum Supply

If the cryptocurrency has a fixed, predefined maximum supply that won't increase, it falls into the deflationary category. For example, Litecoin's maximum supply is 84 million coins.

Circulating Supply

The circulationary supply is another crucial indicator. If this figure is consistently increasing due to minting or mining, it means the cryptocurrency is inflating. A steady or falling circulating supply, on the other hand, implies a deflationary cryptocurrency.

To explore more details about Crypto Supply you can read this article ”Crypto Token Supply Defined: What The 3 Main Supplies Mean”.

Conclusion

As you navigate this dynamic space, stay updated on the supply dynamics of your chosen cryptocurrencies. Whether you opt for the flexibility of inflationary tokens or the scarcity-driven appeal of deflationary ones, remember that the crypto landscape is full of opportunities and risks.

If you're looking to maximize your cryptocurrency mining potential, consider exploring Bitdeer, a world-leading crypto platform that makes your crypto journey both rewarding and accessible.

DISCLAIMER

*Information provided in this article is for general information and reference only and does not constitute nor is intended to be construed as any advertisement, professional advice, offer, solicitation, or recommendation to deal in any product. No guarantee, representation, warranty or undertaking, express or implied, is made as to the fairness, accuracy, timeliness, completeness or correctness of any information, or the future returns, performance or outcome of any product. Bitdeer expressly excludes any and all liability (to the extent permitted by applicable law) in respect of the information provided in this article, and in no event shall Bitdeer be liable to any person for any losses incurred or damages suffered as a result of any reliance on any information in this article.