GPU Cloud Instance

Our cloud service makes it easy to deploy container-based GPU instances in seconds, from either public or private repositories. This means that you can get started with GPU computing quickly and easily, without having to worry about managing your own hardware.

Cloud Mining

À tout moment et en tout lieu ! Nous nous occupons des processus fastidieux afin que vous puissiez vous détendre en profitant de récompenses. Commencez à miner en quelques clics !

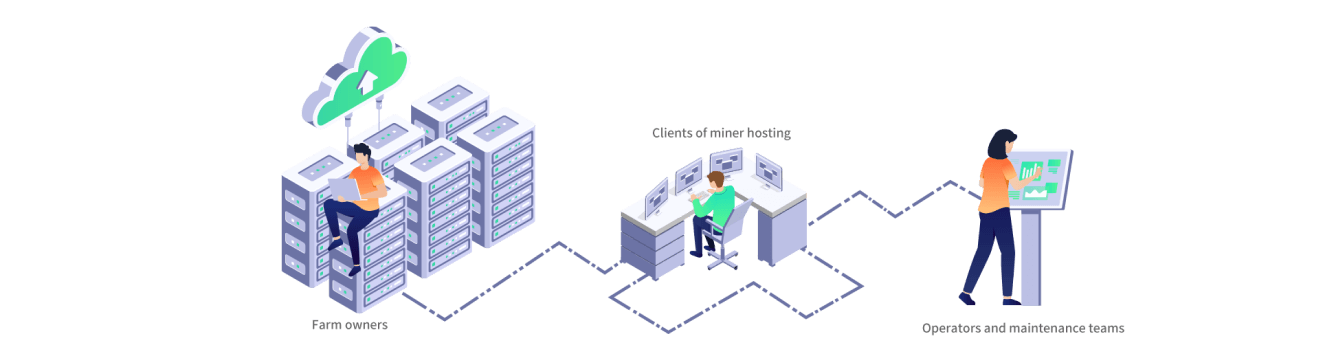

Minerplus

La gestion de votre centre de données vous pose problème ? Nous sommes prêts à vous aider à déployer des systèmes de gestion à interface unique.

Ressources

Parcourez notre centre de ressources pour trouver ce dont vous avez besoin. Abonnez-vous pour rester informé de nos dernières actualités, annonces et publications.

Abonnez-vous à notre bulletin d’informations

Blog sur les crypto et le minage de Bitcoin . Feb 09 2023

How to invest in Bitcoin Mining - A beginners guide

With the rise of cryptocurrencies, you may have heard of mining and wish to participate. In this blog, we will break down the 3 major ways to invest in Bitcoin Mining. We'll go through the fundamentals as well as some handy tips. If you read all the way to the end, you will likely to invest in Bitcoin Mining like a pro.

You've probably heard something about cryptocurrency mining here and there. There are three ways to get started if you want to ride the wave.

- Invest in cryptocurrency mining companies through equity investments or stock purchases. Equity investment has significant entry barriers. Purchasing Bitcoin Mining stocks, on the other hand, is low-hanging fruit. Canaan, Riot Blockchain, Hive, Bitfarm, Marathon, and others are among the popular stocks recommended by Nasdaq. You can examine stock options at exchanges in your area. Because the stock market is volatile, you should always conduct your own due diligence investigation and thoroughly understand the company's business model and financial reports. Previous success does not guarantee current investment success.

- Solo mining (a.k.a home mining). If you are tech-savvy, have a decent disposable income, and have plenty of free time, solo mining may be an option for you. You can begin mining operations by investing in mining hardware, installing suitable mining software, and connecting to mining pools. Be aware that mining rigs produce a great deal of noise and heat. To extend the life of your machine, ensure that it is kept cool. Another thing to keep in mind is that mining rigs are typically unaffordable during bull markets, and prices plummet dramatically during bear markets. Consider the timing of your purchase.

- Cloud mining. You can rent mining hardware and have it hosted by a third-party provider with cloud mining. If you do not have the upfront costs or technical expertise to set up your own mining hardware, this can be a good option. It is important to note, however, that cloud mining has its own set of risks, such as the possibility of scams. It is critical to thoroughly research any platforms before investing.

It is important to note that cryptocurrency mining may not be suitable for everyone. Make sure to carefully consider all of the risks and costs before investing in mining or getting into the crypto market.

What is Bitcoin Mining?

Cryptocurrency mining is the process of verifying transactions on a blockchain and adding them to the public ledger. Miners use special software to solve math problems and are rewarded with a certain number of cryptocurrencies for their efforts. Cryptocurrencies are a relatively new form of digital currency, with the most famous one being Bitcoin and Ethereum.

Bitcoin Mining has become popular because it can be a profitable endeavor. The value of many cryptocurrencies have increased significantly over the past few years, and mining can be a good way to earn a return on investment. Additionally, mining can be a good way to support the blockchain network and help process transactions, which can be beneficial for the cryptocurrency community as a whole. For some people, mining is a way for them to earn cryptos without directly buying it on an exchange. Its decentralization allows anyone with the necessary equipment and knowledge to participate in mining, making it accessible for people to get involved in the cryptocurrency market.

Should I invest in Bitcoin Mining?

There are a few reasons why you might consider investing in Bitcoin Mining:

- Potential for profits: Cryptocurrency prices can be volatile, but if you choose to mine a coin that is in high demand, you may be able to sell it for a profit.

- Diversification: Cryptocurrency mining can be a way to diversify your investment portfolio.

- Passive income: Once you have set up your mining rig, it can potentially generate a passive income for you as long as it is running and you are continually mining a profitable cryptocurrency.

However, there are a few reasons why you may not want to invest in Bitcoin Mining:

- Expensive to set up: It can be expensive to set up a crypto-mining operation. You need to purchase specialized hardware, which can be costly, and you also need to consider the cost of electricity and other overhead expenses.

- Bitcoin Mining can be risky: The value of cryptocurrencies can be volatile, and there is no guarantee that you will be able to sell your mined coins for a profit.

- Bitcoin Mining can be energy-intensive: The process of mining cryptocurrencies requires a lot of computational power, which consumes a lot of electricity. This can be a concern for those who are interested in reducing their carbon footprint.

- Bitcoin Mining can be competitive: There are a lot of people and organizations competing to mine cryptocurrencies, and the difficulty of the mining process can increase over time. This means that it can be difficult to turn a profit from Bitcoin Mining.

Overall, cryptocurrency mining is a high-risk, high-reward activity and may not be suitable for everyone. Like any other investment strategy, it's important to do your own research and carefully consider the risks before deciding whether or not to invest in it.

What do I need to invest in Bitcoin Mining?

As mentioned earlier, there are three major ways that you can invest in Bitcoin Mining. The following guide focuses on solo mining and cloud mining.

To start mining by yourself, you will need the following:

- A specialized mining hardware designed for the coin you intend to mine;

- A cryptocurrency wallet (crypto wallet or digital wallet) to store the coins you mine;

- A mining pool membership. This is optional but recommended, as it increases your chances of successfully mining a block and getting rewarded.

- A software program to run the mining process.

You will also need to consider the costs of electricity and a stable internet connection, as Bitcoin Mining can be resource-intensive and requires a connection to the internet to work.

Cloud mining, on the other hand, allows you to mine cryptocurrencies without the need to purchase and set up your own physical mining rigs. Instead, you pay a fee to a cloud mining service provider, which will use its own mining hardware to mine the cryptocurrency on your behalf.

To get started with cloud mining, you will need to research and compare different cloud mining service providers. Look for a reputable provider with a track record of stability and security. Then you will decide which cryptocurrency to mine. Generally, you can follow the platform guide once you’ve decided on the service provider and minable coins. Cloud mining sites like Bitdeer allow you to select machine models, mining durations and mining pools. All fees (hashrate fee and electricity fee) are displayed at the time of purchasing. With a few clicks, you can start mining cryptocurrency.

What are some good coins to invest in?

There are many different PoW (proof-of-work) cryptocurrencies available, and it can be challenging to choose which ones to invest in. Some popular coins include

but there are many other options to consider as well. It's important to do your own research and consider factors such as the coin's technology, adoption rate, and market cap before making an investment. It's also a good idea to diversify your portfolio to spread out your risk.

How long does it take to make profit off Bitcoin Mining

It can be difficult to predict how long it will take to make a profit from mining cryptocurrencies. There are many factors that can affect your profitability, including the cost of your mining hardware, mining operation and the electricity required to run it, and the value of coins on the market.

In general, mining is more profitable when the value of the coins you are mining is high and the cost of your mining is low. However, the value of cryptocurrencies can be volatile, and there is no guarantee that you will be able to sell your coins for a profit. At Bitdeer, our product page provides you with an estimation on when you can break even your cost.

Bitcoin Mining Investing Tips

A few tips to consider if you’re interested in investing in Bitcoin Mining:

- DYOR (Do your own research): It's important to thoroughly research a coin and its technology before investing. Look for information from a variety of sources and consider factors such as the coin's adoption rate, market cap, and technology.

- Consider the cost of mining: Mining can be an expensive proposition, especially when you factor in the cost of hardware and electricity (check the costing structures if you are using cloud mining services). Make sure you have a good understanding of these costs before you invest.

- Diversify your portfolio: It's a good idea to diversify your portfolio to spread out your risk. Don't put all of your money into one coin or mining venture.

- Be prepared for volatility: The value of cryptocurrencies can be volatile, and there is no guarantee that you will be able to sell your coins for a profit. Stay up-to-date on market conditions and be prepared to adjust your mining strategy as needed.

Remember, investing in Bitcoin Mining is like any other investments that carry inherent risks and there is no guarantee of profit. It's important to carefully consider these risks before making any investments.

How is Bitcoin Mining taxed?

Cryptocurrency mining can be taxed in a number of ways, depending on the specifics of the operation and the jurisdiction in which it is located.

In the United States, the Internal Revenue Service (IRS) considers cryptocurrency mining to be taxable by law. Any income generated through mining operations is subject to federal income tax, and miners may be required to pay self-employment tax if they are considered to be running a business.

The tax treatment of cryptocurrency mining can vary depending on the specific facts and circumstances of the operation. For example, if the mining activity is considered a hobby rather than a business, the income generated may be subject to different tax rules.

It is important to keep in mind that the tax treatment of cryptocurrency mining may vary depending on your specific circumstances. You should consult with a tax professional or the IRS for guidance. They can help you understand the tax rules that apply to your specific situation and advise you on how to properly report your income and expenses.

How long will Bitcoin Mining last?

It is difficult to predict how long Bitcoin Mining will last. Some people even call Bitcoin Mining dead since Ethereum has fully transacted to proof-of-stake (PoS) consensus algorithms. Such changes does not mean the end of cryptocurrency mining, but the evolution itself. For example, it has become necessary for miners to use specialized hardware, such as application-specific integrated circuits (ASICs), to be competitive.

The future of Bitcoin Mining will ultimately depend on a variety of factors such as the value of the cryptocurrency being mined, the cost of mining production (i,e electricity costs, computing power, advancements in mining equipment), and the overall level of demand for the cryptocurrency. Regulations (including environment protection) and the ongoing development of new technologies will also help shape the future of cryptocurrency mining.

Invest in crypto through cloud mining today!

If you are interested in investing in cryptos though cloud mining, make sure to find reliable service providers. Mining sites like Bitdeer allow you to start Bitcoin Mining in a few steps. Get started today!

DISCLAIMER

*Information provided in this article is for general information and reference only and does not constitute nor is intended to be construed as any advertisement, professional advice, offer, solicitation, or recommendation to deal in any product. No guarantee, representation, warranty or undertaking, express or implied, is made as to the fairness, accuracy, timeliness, completeness or correctness of any information, or the future returns, performance or outcome of any product. Bitdeer expressly excludes any and all liability (to the extent permitted by applicable law) in respect of the information provided in this article, and in no event shall Bitdeer be liable to any person for any losses incurred or damages suffered as a result of any reliance on any information in this article.